The Chancellor has set out further details on how the Coronavirus Job Retention Scheme will continue to support jobs and business as people return to work.

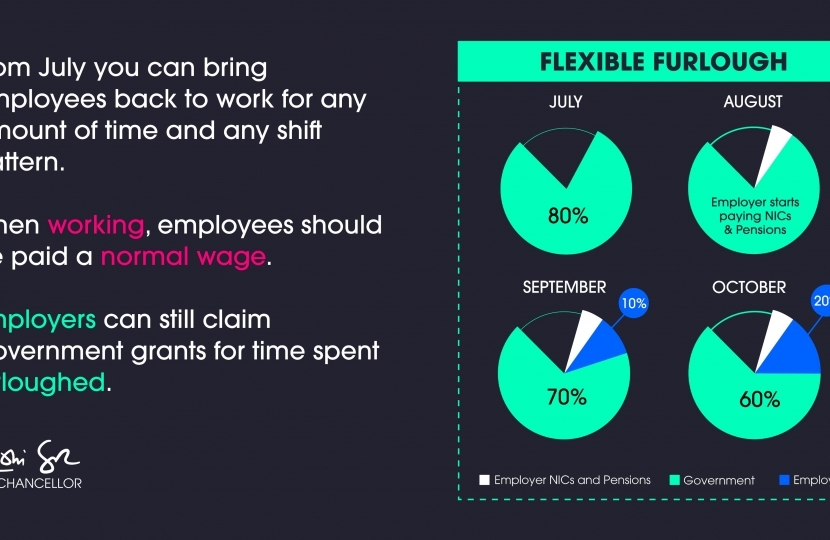

In June and July, nothing will change for employers and the Government will continue to pay 80% of people's salaries. From August, the level of the grant will be slowly reduced and employers will be required to top up the Government payment to ensure employees receive 80% of their normal pay, up to a monthly cap of £2,500.

From July, businesses can bring furloughed employees back part time. This is a month earlier than previously announced to help support people back to work. Employers will be able to claim the furlough grant for the promotion of the employees' normal hours they are not working - but they must pay their employees for the hours they are working. The Government will continue to pay 80% of wages up to £2,500, plus employer National Insurance and pension contribution.

From August, the job retention scheme will be slowly tapered to reflect that people will be returning to work. The Government will pay 70% of wages up to a cap of £2,190. Employers will be asked to pay the remaining 10%, in addition to employer National Insurance and pension contributions.

From October, the Government will pay 60% of wages up to a cap of £1,875. Employers will be asked to pay the remaining 20%, in addition to employer National Insurance and pension contributions.

More information can be found via: https://www.gov.uk/government/news/chancellor-extends-self-employment-s…